Decoding Auto Insurance: Understanding the Differences Between Comprehensive and Collision Coverage in New York State

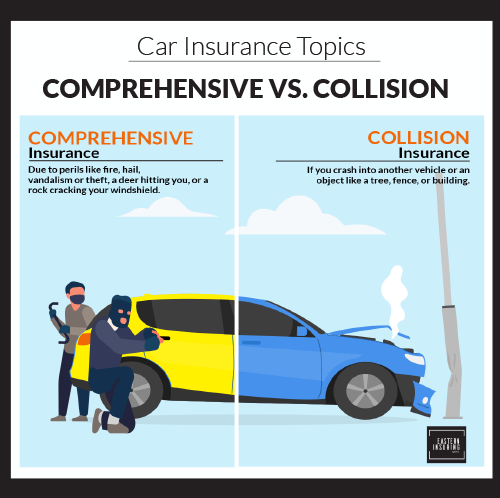

Auto insurance can be complex, with various coverage options designed to protect against different types of risks. Two fundamental components of auto insurance—Comprehensive and Collision Coverage—play distinct roles in shielding drivers from financial losses. In this blog, we'll unravel the differences between Comprehensive and Collision Coverage in the context of New York State (NYS) auto insurance.

Defining Comprehensive Coverage:

What is Comprehensive Coverage? Comprehensive Coverage, often referred to as "Comp," is an auto insurance component that provides protection against non-collision-related damages. This includes losses due to theft, vandalism, natural disasters, falling objects, and contact with animals. Essentially, Comprehensive Coverage safeguards your vehicle from events beyond standard accidents.

Pros of Comprehensive Coverage:

- Protection Against Non-Collision Events: Comprehensive Coverage extends protection to a wide range of non-collision incidents, offering financial support for damages caused by events such as hailstorms, fire, or theft.

- Coverage for Animal Collisions: Collisions with animals, such as deer or pets, are covered under Comprehensive Coverage. This is particularly relevant in regions with a higher risk of such incidents.

- Vandalism and Theft Protection: Comprehensive Coverage provides a safety net against vandalism and theft, ensuring that the costs of repairing damages or replacing a stolen vehicle are covered.

Cons of Comprehensive Coverage:

- Deductibles Apply: Similar to other insurance coverages, Comprehensive Coverage often involves deductibles—out-of-pocket expenses that the policyholder must pay before the insurance coverage kicks in.

- Does Not Cover Collision Damage: Despite its broad scope, Comprehensive Coverage does not cover damages resulting from standard collisions with other vehicles or objects.

Defining Collision Coverage:

What is Collision Coverage? Collision Coverage, as the name suggests, is designed to protect against damages resulting from collisions with other vehicles or objects. This includes accidents where the insured driver is at fault or when the responsible party is uninsured.

Pros of Collision Coverage:

- Protection for Collision Damage: The primary purpose of Collision Coverage is to provide financial protection for damages incurred during collisions with other vehicles, objects, or even rollovers.

- Coverage Regardless of Fault: Collision Coverage applies irrespective of fault, ensuring that the insured vehicle is protected even if the policyholder is responsible for the accident.

Cons of Collision Coverage:

- Deductibles Apply: Similar to Comprehensive Coverage, Collision Coverage often involves deductibles that the policyholder must pay before the insurance coverage takes effect.

- Higher Premiums: The inclusion of Collision Coverage in an auto insurance policy may contribute to higher premiums. Policyholders should assess the cost-benefit ratio based on their individual circumstances.

Comprehensive and Collision Coverage are integral components of auto insurance, each offering specific protections against different risks. When crafting an auto insurance policy in New York State, carefully evaluating your needs, considering potential risks, and consulting with your agent at Eastern Insuring Agency will help you strike the right balance between Comprehensive and Collision Coverage. This ensures that you have a robust and tailored defense against a range of potential damages and losses on the road.

Message from Eastern Insuring Agency:

Navigating the intricacies of insurance coverage requires a personalized approach, taking into account your unique circumstances, preferences, and financial goals. To gain a comprehensive understanding of the information provided in this blog and its direct relevance to your specific insurance needs, we encourage you to reach out to your dedicated agent at Eastern Insuring Agency at 1.800.698.1222.

Our team is here to guide you through the decision-making process, answer any questions you may have, and ensure that you have the right coverage in place for your peace of mind. Your agent at Eastern Insuring Agency is committed to providing the expertise and support you need to make informed choices and safeguard what matters most to you.

Recent posts